The Challenge

The founders wanted to revolutionize how insurance is delivered inside digital

products, but the path to execution required solving several deep technical

challenges:

-

Ecosystem Integration

Creating seamless data flow between carriers, brokers, and business

platforms—each with different systems and requirements.

-

Real-Time Performance

Building an architecture capable of fast quoting, instant renewals, and

high-volume claims processing.

-

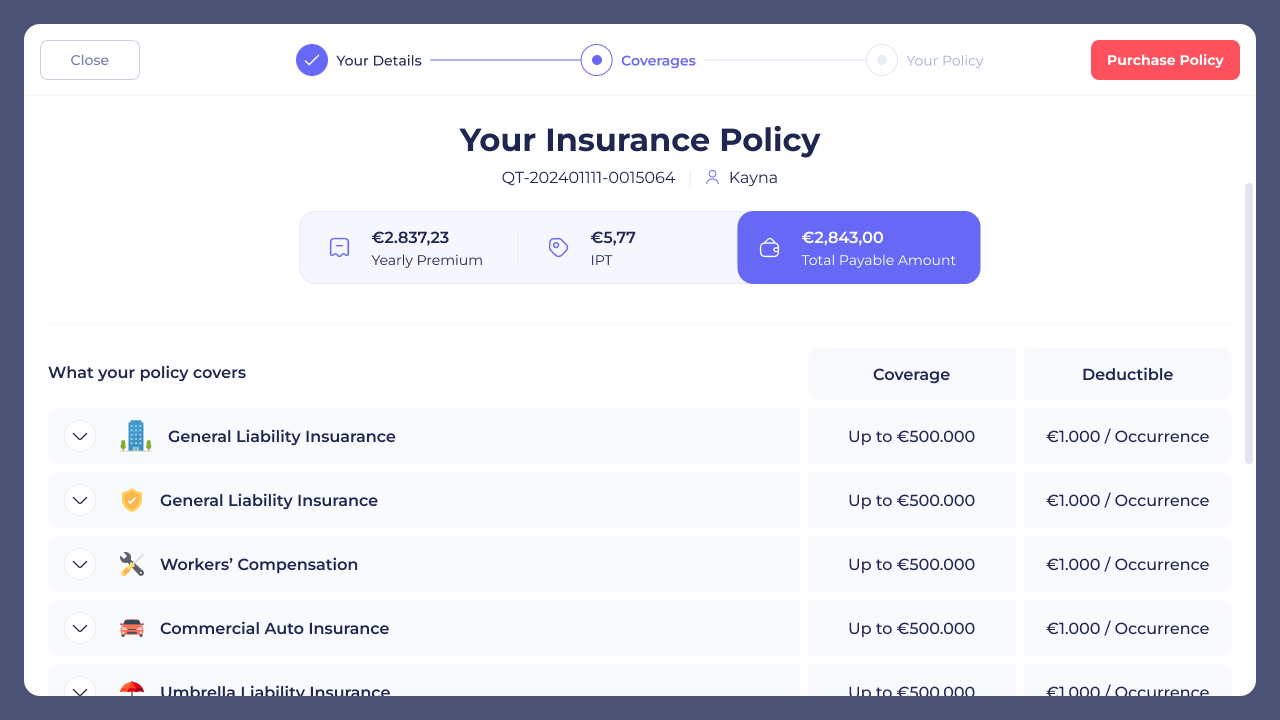

Simple Embedding

Developing a lightweight, easy-to-drop-in React widget for businesses to

embed insurance offerings directly inside their product.

-

Unified Management

Designing a dashboard that lets users manage policies, customer data,

quotes, and claims in one clean interface.

-

Workflow Simplification

Turning traditionally complex insurance processes into intuitive, guided

steps that any business can operate.

![]()

In a dynamic business environment, scalability is crucial. IT services provide the flexibility to scale up or down your resources based on changing business needs. Cloud services, for instance, allow seamless expansion of storage and computational power

Serana Belluci

Product Designer

Our Solution

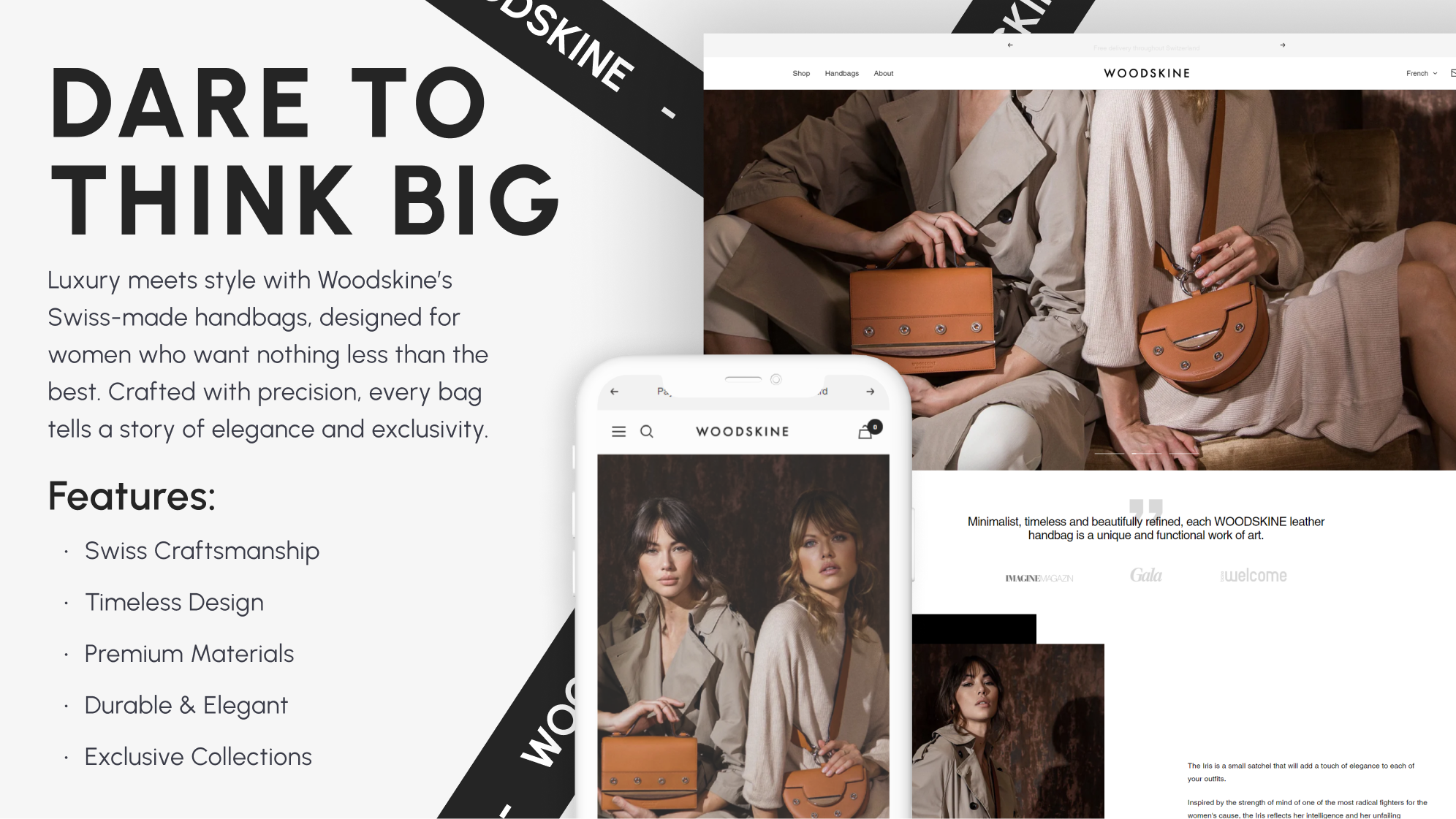

Zenveus built a full-stack product ecosystem designed for scale, speed, and ease

of adoption.

-

Embeddable Widget

A plug-and-play React component that businesses can integrate within

minutes.

-

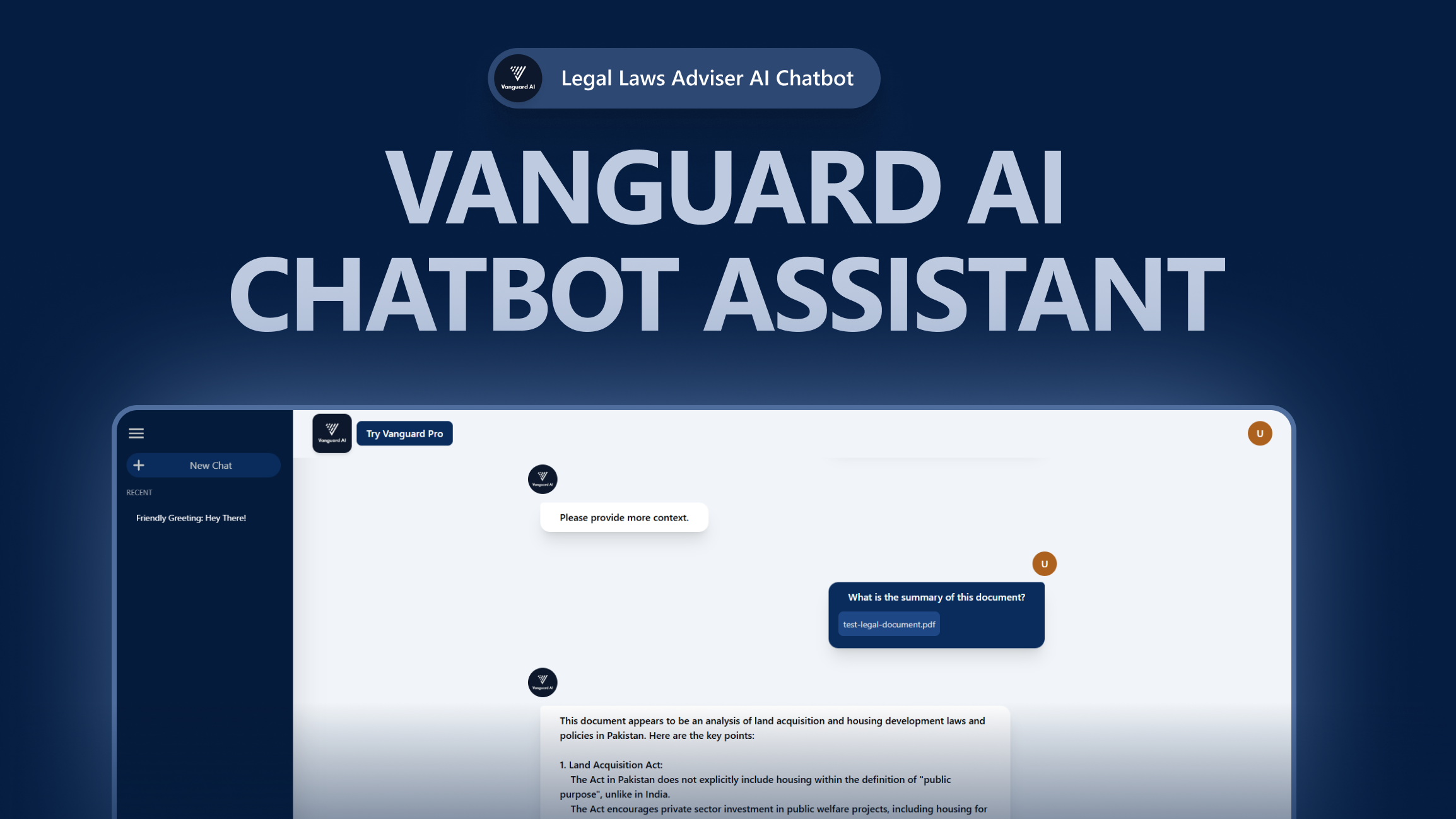

Operational Dashboard

A centralized, user-friendly dashboard for handling policies, quotes,

claims, and customer activity.

-

Scalable Backend Architecture

A robust backend that manages data exchange between carriers, brokers, and

platforms—ensuring reliability and real-time performance.

-

Data & Insights Layer

Tools for reporting, analytics, and smarter underwriting and operational

decisions.

-

Streamlined UX/UI

A clean, intuitive experience that simplifies complex workflows and reduces

friction for both businesses and end-users.

The Outcome

The result is a modern embedded insurance platform that reduces operational overhead, accelerates quoting and claims, and enables businesses to deliver custom insurance products quickly and efficiently.

Our close collaboration with the founding team helped bring a category-defining insurtech product to life—one engineered for scale, adoption, and long-term growth.